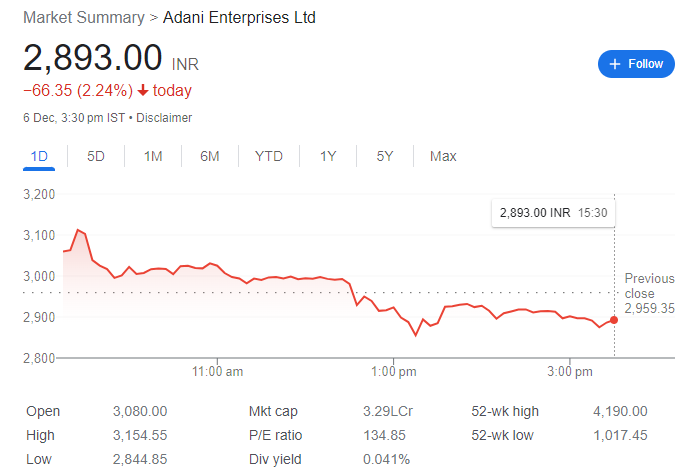

Adani Stocks: A Rollercoaster Ride or a Sustainable Growth Story?

Investors considering adding Adani stocks to their portfolios should carefully weigh the potential risks and rewards.

The Adani Group, an Indian multinational conglomerate, has witnessed a meteoric rise in recent years, becoming one of the most valuable companies in India. This rapid growth has been driven by significant investments in various sectors, including infrastructure, ports, renewable energy, and commodities. However, the Adani Group's stock performance has been a roller coaster ride, leaving investors wondering whether it's a sustainable growth story or a bubble waiting to burst.

Reasons for the Adani Stock Surge:

There are several factors that have contributed to the surge in Adani stocks:

- Strong business fundamentals: The Adani Group operates in sectors with favorable long-term growth prospects. Its focus on infrastructure, ports, and renewable energy aligns with India's development priorities, creating a supportive policy environment.

- Aggressive expansion: The Adani Group has been aggressively expanding its businesses through acquisitions and organic growth initiatives. This expansion has fueled revenue and profit growth, attracting investor interest.

- Market optimism: The overall Indian stock market has been performing well, with investors favoring companies with strong growth potential. This positive market sentiment has contributed to the rise in Adani stocks.

- Focus on ESG: The Adani Group has recently placed a strong emphasis on environmental, social, and governance (ESG) practices. This commitment to sustainability has resonated with investors increasingly focusing on ethical and responsible investment strategies.

Concerns and Risks:

Despite the positive factors, some concerns and risks remain:

- High debt levels: The Adani Group has a high debt burden, which could become unsustainable if interest rates rise or the company's growth stumbles.

- Valuations: Adani stocks are currently trading at relatively high valuations, raising concerns about potential overvaluation and downside risks.

- Conglomerate structure: The Adani Group operates a diverse range of businesses, which can make it difficult to manage and assess overall risks.

- Market corrections: As with any stock, Adani stocks are susceptible to broad market corrections, which could lead to significant losses.

Is it a Sustainable Growth Story?

Whether the Adani Group's growth is sustainable remains to be seen. The company's success will depend on its ability to execute its expansion plans effectively, manage its debt levels responsibly, and adapt to changing market conditions. Additionally, the company needs to address concerns about its governance and transparency to maintain investor confidence.

Investment Considerations:

Investors considering adding Adani stocks to their portfolios should carefully weigh the potential risks and rewards. A thorough analysis of the company's financials, business strategy, and market conditions is essential before making any investment decisions. Diversification across different sectors and stock types is crucial to mitigating potential risks.

Overall, the Adani Group presents a compelling investment opportunity for investors seeking exposure to India's high-growth sectors. However, the high debt levels and potential for market corrections necessitate a cautious approach. Investors should carefully consider the risks involved before investing in Adani stocks.

Fine End

Fine End