Mutual funds: A smart way to invest for your future

There are a variety of different types of mutual funds available, with its own investment objective. Some common types of mutual funds include

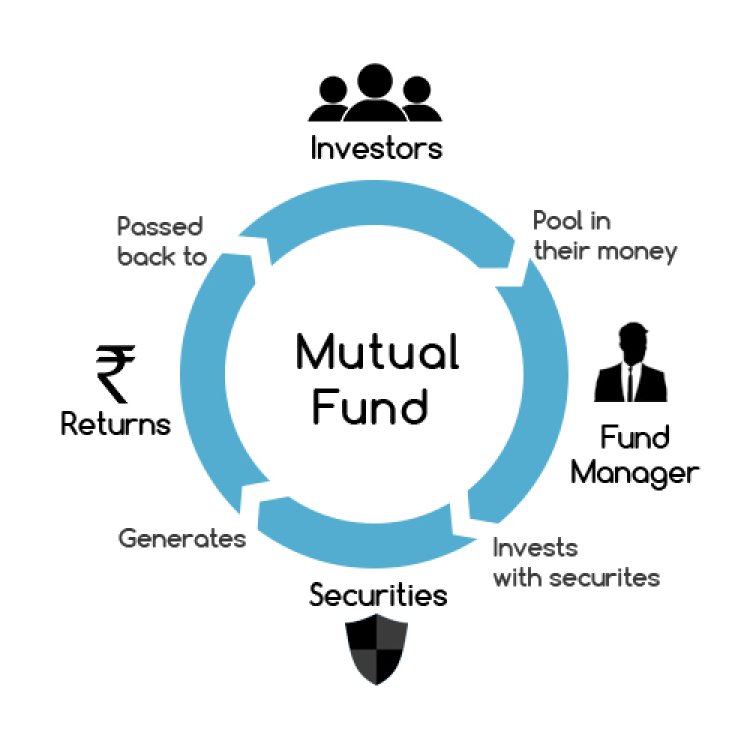

Mutual funds are a type of investment vehicle that pool money from investors and invest it in a variety of securities, such as stocks, bonds, and money market instruments. Mutual funds offer a number of advantages over other investment options, including:

- Diversification: Mutual funds allow investors to diversify their portfolios across a variety of securities, which can help to reduce risk.

- Professional management: Mutual funds are managed by professional investment managers who have the expertise to select and manage a diversified portfolio of securities.

- Convenience: Mutual funds are easy to invest in and trade. Investors can buy and sell mutual fund shares through a broker or directly from the mutual fund company.

There are a variety of different types of mutual funds available, each with its own investment objective. Some common types of mutual funds include:

Mutual funds can be a good investment for investors of all experience levels. They are a relatively low-cost way to invest in a diversified portfolio of securities. Mutual funds can also be a good way to save for retirement or other long-term goals.

- Stock funds: Stock funds invest in stocks, which are shares of ownership in companies.

- Bond funds: Bond funds invest in bonds, which are loans that investors make to governments or corporations.

- Money market funds: Money market funds invest in short-term debt securities, such as Treasury bills and commercial paper.

How to choose a mutual fund

When choosing a mutual fund, it is important to consider your investment goals, risk tolerance, and time horizon. You should also consider the fees associated with the fund.

Here are some tips for choosing a mutual fund:

Once you have considered your investment goals, risk tolerance, time horizon, and fees, you can start to research specific mutual funds. You can use a variety of resources to research mutual funds, such as mutual fund websites, financial websites, and investment advisors.

- Define your investment goals: What are you saving for? Retirement? A down payment on a house? A child's education? Once you know your investment goals, you can start to narrow down your choices.

- Consider your risk tolerance: How much risk are you comfortable with? Mutual funds can vary in risk from low to high. If you are not comfortable with risk, you may want to choose a fund with a lower risk profile.

- Think about your time horizon: When do you need to access your money? If you need your money in the short term, you may want to choose a fund with a more conservative investment approach. If you have a longer time horizon, you may be able to afford to take on more risk.

- Compare fees: Mutual funds charge fees for management and administration. It is important to compare the fees of different funds before you invest.

Conclusion

Mutual funds can be a smart way to invest for your future. They offer a number of advantages over other investment options, including diversification, professional management, and convenience. By carefully choosing a mutual fund that meets your investment needs, you can build a strong financial future.

Fine End

Fine End